IPO Report and Trend Analysis for January 2025: Exciting Opportunities for Investors

Understanding the IPO landscape is crucial for investors looking to make informed decisions, and access to data on upcoming IPOs provides key insights. This data provides valuable information about the company’s filing their Draft Red Herring Prospectus (DRHP), the sectors they belong to, and the merchant bankers associated with them.

By analyzing this information, investors can identify emerging opportunities, assess market trends, and make more strategic choices. With the right data, investors can stay ahead of the curve, ensuring they don’t miss out on promising IPOs and can optimize their investment strategies for better returns.

In the month of January, 31 companies filed their Draft Red Herring Prospectus (DRHP). Of these, 13 DRHPs were filed on BSE SME exchange and 18 with the NSE Emerge.

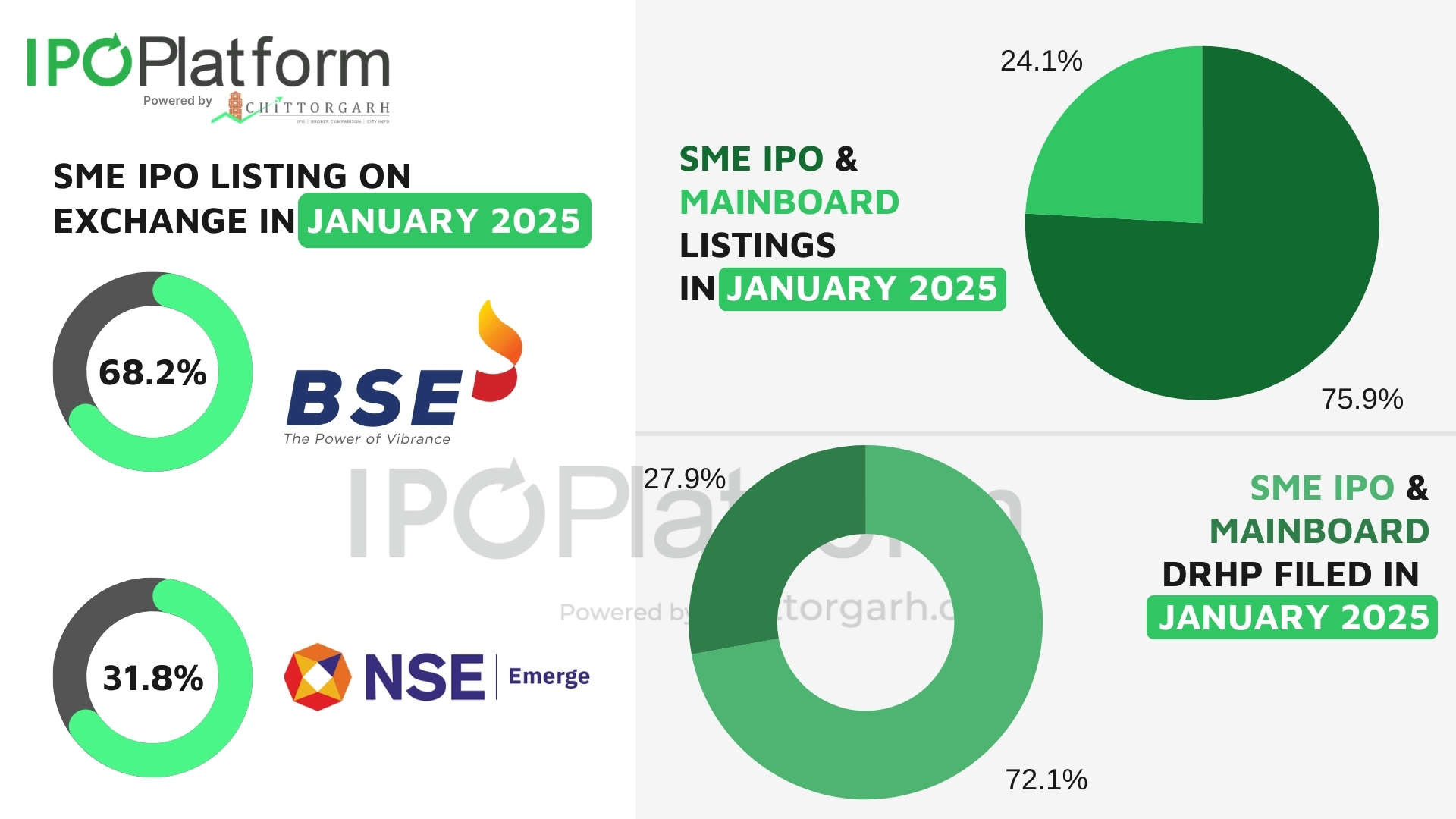

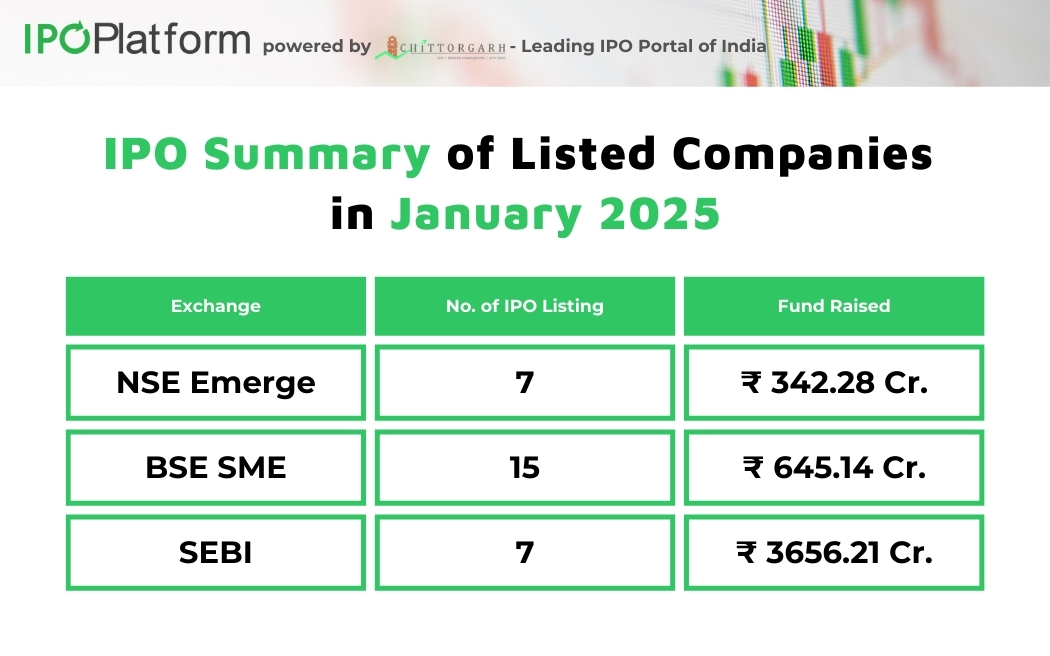

Additionally, 22 SME IPOs were listed in January 2025, reflecting strong investor interest in smaller companies.

On mainboard platform, 12 companies filed DRHPS in the month of January 2025. Additionally, 7 Companies got listed in January 2025.

IPO Report and trend analysis offers valuable information on upcoming IPOs, to spot opportunities based on sectors, cities, and merchant bankers for the investors. Platforms like ipoplatform.com provide real-time updates, ensuring investors stay informed and ready to capitalize on the next big opportunity. With detailed IPO listings, sector insights, and expert advice, IPO Advisors make it easier for investors to make confident, data-driven decisions

Primary Market Highlights (IPOs) in the month of January 2025

A. 31 Companies have filed DRHP with Recognized Stock Exchanges such as;

- 13 Companies filed DRHP with BSE SME exchange and,

- 18 Companies filed DRHP with NSE Emerge

B. 12 Companies filed DRHP with SEBI (Mainboard)

C. 22 SME IPO listings in the month of January on NSE Emerge and BSE SME.

D. 7 IPO listings on Mainboard.

E. IPOs to open in first week of February;

- Amwill Health Care Limited

- Readymix Construction Machinery Limited,

- Eleganz Interiors Limited

- Chamunda Electrical Limited

- Ken Enterprises Limited

List of Upcoming SME IPOs for which DRHPs are filed with BSE SME Exchange

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|

|

Revenue |

PAT (Profit after Tax) |

|

|

|

|

29.43 |

2.64 |

Ambala |

Education - Edtech |

||

|

42.16 |

5.66 |

Ludhiana |

Textiles - Fabrics |

||

|

59.24 |

6.22 |

Mumbai |

Chemicals |

||

|

91.06 |

8.32 |

Mumbai |

Rubber |

||

|

26.81 |

4.47 |

Rajkot |

Engineering |

||

|

33.39 |

5.05 |

Mumbai |

Pharmaceutical |

||

|

98.65 |

9.46 |

Bharuch |

Chemicals |

||

|

84.7 |

3.9 |

New Delhi |

FMCG |

||

|

160.44 |

28.1 |

Raigarh |

Defence |

||

|

4.02 |

0.42 |

Ahmedabad |

Information Technology- |

||

|

82.56 |

5.44 |

New Delhi |

Information Technology |

||

|

401.68 |

7.38 |

Rajkot |

Agro |

||

|

63.3 |

7.74 |

Agartala |

Engineering – EPC |

||

List of Upcoming SME IPOs for which DRHPs are filed with NSE Emerge

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|

|

Revenue |

PAT (Profit after Tax) |

|

|

|

|

205.02 |

9.27 |

Bangalore |

Banking and Finance - FinTech |

||

|

99.03 |

5.91 |

Jabalpur |

Outsourcing - BPO |

||

|

374.45 |

19.25 |

Bhopal |

Plastic and Polymer |

||

|

210.07 |

9.72 |

Rajkot |

Textiles - Fabrics |

||

|

125.06 |

14.06 |

Mumbai |

Advertising and Media - Events |

||

|

314.64 |

27.04 |

Mumbai |

Chemical |

||

|

92.48 |

10.92 |

Mumbai |

Logistics |

||

|

162.68 |

6.86 |

Hyderabad |

Logistics |

||

|

37.82 |

3.84 |

Kolkata |

Telecom |

||

|

32.49 |

8.62 |

Bishnupur |

Engineering |

||

|

267.44 |

24.26 |

Kolkata |

Packaging & Disposables |

||

|

82.96 |

19.22 |

Ahmedabad |

Advertising and Media - Events |

||

|

35.67 |

4.71 |

Ahmedabad |

Pharmaceutical |

||

|

46.65 |

5.19 |

Jamnagar |

Plastic and Polymer |

||

|

23.86 |

8.30 |

Mumbai |

Advertising and Media - Events |

||

|

120.96 |

12.24 |

Pune |

Seren Capital Private Limited |

Corporate Solutions |

|

|

191.18 |

11.98 |

Rajkot |

Aluminium |

||

|

63.48 |

5.23 |

Ahmedabad |

Logistics |

||

List of Upcoming Mainboard IPOs for which DRHPs are filed with SEBI

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|

|

Revenue |

PAT(Profit after tax) |

|

|

|

|

Shreeji Shipping Global Limited |

601.8 |

161 |

Jamnagar |

Elara Capital (India) Private Limited see more |

Logistics |

|

Gaudium IVF and Women Health Limited |

63.38 |

16.28 |

New Delhi |

Sarthi Capital Advisors Private Limited |

Healthcare - Hospitals and Clinic |

|

Epack Prefab Technologies Limited |

1079.8 |

55.2 |

Noida |

Motilal Oswal Investment Advisors Limited |

Plastic and Polymer |

|

Dorf-Ketal Chemicals India Limited |

6045.6 |

463.2 |

Kachchh |

JM Financial Limited |

Chemicals |

|

Karamtara Engineering Limited |

2670.8 |

117.8 |

Mumbai |

IIFL Capital Services Limited See more |

Solar |

|

Kent RO Systems Limited |

1368 |

139.2 |

Delhi |

Motilal Oswal Investment Advisors Limited See more |

Electric Equipments |

|

Euro Pratik Sales Limited |

287.8 |

86.8 |

Mumbai |

Mayuri Arya/Pavan Naik See more |

Furniture |

|

Luminos Industries Limited |

1939.2 |

128.6 |

Kolkata |

Motilal Oswal Investment Advisors Limited See more |

Engineering - EPC |

|

Vinir Engineering Limited |

214.4 |

40.4 |

Bangalore |

Pantomath Capital Advisors PrivateLimited See more |

Engineering - Heavy Machinery |

|

Shanti Gold International Limited |

1019.2 |

36.4 |

Mumbai |

Choice Capital Advisors Private Limited See more |

Jewellery |

|

Veritas Finance Limited |

1440.2 |

266.2 |

Chennai |

ICICI Securities Limited See more |

Banking and Finance - FinTech |

|

Vidya Wires Limited |

1511.2 |

34.8 |

Anand |

Pantomath Capital Advisors Private Limited See more |

Cables and wire |

|

Jesons Industries Limited |

1459.8 |

62.2 |

Mumbai |

Motilal Oswal Investment Advisors Limited See more |

Chemical - Paint and Adhesives |

Details of Listed Companies in the month of January 2025

IPOs (SME and Mainboard) to open in the first week of February 2025

- Amwill Health Care Limited, founded in 2017, is a derma-cosmetic company specializing in skincare solutions. It collaborates with contract manufacturers, distributors, and third-party developers to enhance its manufacturing, packaging, and distribution capabilities. The company focuses on two main product categories: generic dermatological solutions and targeted treatments for skin concerns. Unistone Capital Private Ltd is the book-running lead manager for this IPO.

- Readymix Construction Machinery Limited, established in 2012, manufactures and supplies construction equipment like Dry Mix Mortar Plants, silos, and concrete support systems. It provides turnkey solutions from design to after-sales service. Hem Securities Limited is the lead manager for this IPO.

- Eleganz Interiors Limited, incorporated in 1996, specializes in providing interior solutions for corporate offices, laboratories, airport lounges, and commercial spaces. The company offers fit-out solutions and participates in domestic tenders for design and build (D&B) and general contracting (GC) projects. Vivro Financial Services Private Limited is BRLM for its IPO.

- Ken Enterprises Limited, established in 1998, specializes in textile manufacturing, focusing on greige fabric production in Ichalkaranji, Maharashtra. It supplies greige, dyed, printed, and RFD/PFD fabrics for various industries. Corporate Makers Capital Ltd. is the merchant banker for this IPO.

- Chamunda Electricals Limited, established in 2013, specializes in operating, maintaining, and commissioning substations up to 220 KV and solar power generation. The company offers services like EHV equipment erection, earthing, and control cable works, ensuring efficient power infrastructure solutions. With a skilled team of over 600 engineers and supervisors, Chamunda Electricals delivers high-precision projects across the industry. GYR Capital Advisors Private Limited is the book running lead manager for this IPO.

|

Name |

Exchange |

IPO size (in crores) |

IPO Dates |

Price Band |

Merchant Banker |

Sector |

|

Amwill Healthcare Limited |

BSE SME |

59.98 |

5 Feb – 7 Feb 2025 |

Rs. 105 to Rs.111 per share |

Unistone Capital Private Limited |

Healthcare -Personal care

|

|

Readymix Construction Machinery Limited |

NSE Emerge |

37.66 |

6 Feb – 10 Feb 2025 |

Rs. 121 to Rs.123 per share |

Hem Securities Limited |

Engineering |

|

Eleganz Interiors Limited |

NSE Emerge |

78.07 |

7 Feb – 11 Feb 2025 |

Rs. 123 to Rs. 130 per share |

Vivro Financial Services Private Limited |

Home Decor |

|

Ken Enterprises Limited |

NSE Emerge |

83.65 |

5 Feb – 7 Feb 2025 |

Rs. 94 |

Corporate Makers Capital Ltd. |

Textiles |

|

Chamunda Electricals Limited

|

NSE Emerge |

14.60 |

4 Feb – 6 Feb 2025 |

Rs. 47 - Rs. 50 per share |

GYR Capital Advisors Private Limited See more |

Power and Energy |

What is the role of IPO Advisors in listing of an IPO?

IPO Advisors and IPO Consultants play a crucial role in guiding companies through the complex process of listing an Initial Public Offering (IPO). Their primary responsibility is to ensure that the company meets the IPO eligibility and listing requirements set by regulatory authorities and stock exchanges such as BSE SME and NSE Emerge.

Team at ipoplatform.com guide companies through the listing process, helping them meet all necessary requirements and connecting them with the best Merchant Bankers in India to maximize their fundraising potential. With expert advisory, valuation strategies, and investor outreach, IPO Advisors help companies achieve a successful public listing and unlock growth opportunities in the capital markets.

These professionals work closely with Merchant Bankers to structure the IPO, prepare financial disclosures, and ensure compliance with regulatory norms. They assist in drafting the Draft Red Herring Prospectus (DRHP), coordinating with regulatory bodies like SEBI, and facilitating due diligence.

Conclusion: Unlocking Opportunities with IPO 2025

The IPO market in January 2025 has started with strong momentum, with 43 companies filing their DRHPs across BSE SME, NSE Emerge, and the Mainboard. With 29 IPO listings and several upcoming IPOs in February, investors have numerous opportunities to explore.

For companies looking to go public, IPO Advisors play a crucial role in streamlining the IPO listing process. From compliance with regulatory requirements to selecting the right Merchant Bankers, these experts ensure a smooth transition into the capital markets. Platforms like ipoplatform.com provide real-time updates, expert insights, and the necessary guidance to help companies and investors make informed decisions.

As we move further into SME IPO 2025, staying updated on upcoming IPOs and analyzing key financials can help investors capitalize

0 Comments