Introduction- Listing on primary markets is one of the medium of fund raise by the companies seeking growth and expansion. A company can bring IPO on either mainboard or SME platform of the stock exchanges of India. SEBI has issued ICDR Regulations that prescribes the eligibility requirements and regulations for IPO. Here, we have explained the various regulations and listing requirements for SME IPO. This Ebook covers all amendments made in SEBI ICDR Regulations dated 3rd March 2025.

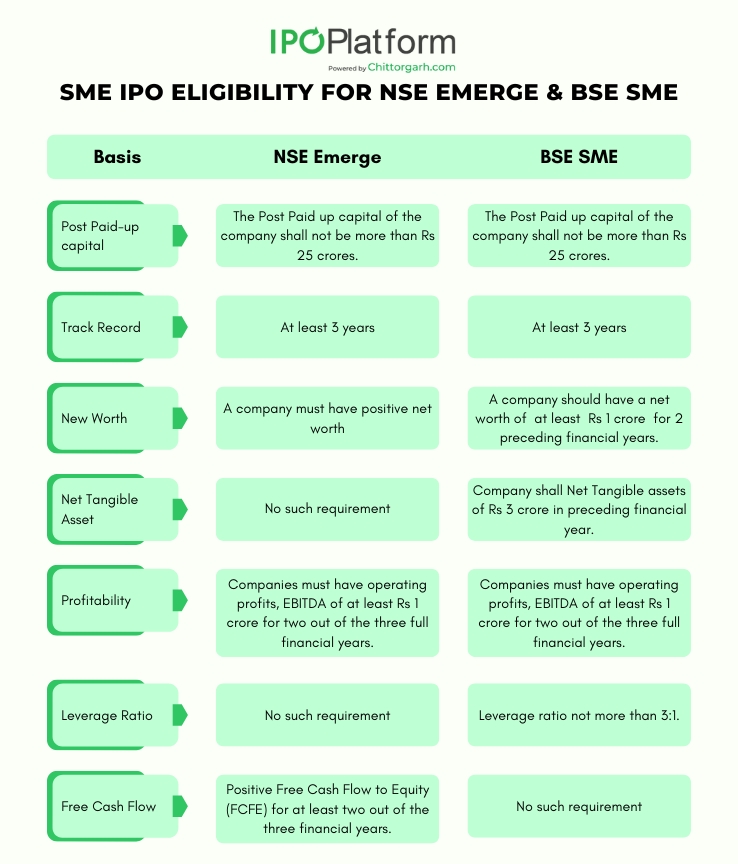

For eligibility purposes minimum operating profits (EBITDA) of at least Rs 1 crore are required for at least 2 out of the 3 previous financial years.

The stock exchanges of India have specified IPO Eligibility Requirements for listing purposes on SME platforms of India. SME companies can list on NSE Emerge or BSE SME on meeting the BSE SME IPO Eligibility criteria and NSE SME IPO Eligibility Criteria as highlighted below.

It states that Free Cash Flow to Equity (FCFE) for at least 2 out of 3 Financial Year.

Other Mandatory Requirements to be fulfilled as per Recent Amendments in the SEBI ICDR for IPO and listing purposes:

|

Particulars |

Changes |

|---|---|

|

Offer for Sale |

SEBI sets a 20% limit on OFS in SME IPOs. Existing shareholders cannot offload more than 50% of pre IPO Holdings. |

|

Repayment of Loan |

SMEs can't use IPO funds to repay loans of promoters or related parties. |

|

Mandatory 1-Year Existence for Converted Entities |

SMEs must complete 1 financial year as a company post-conversion from a proprietorship, partnership, or LLP before filing for an IPO. |

|

Change in Promoter Holding |

A 1-year waiting period is required for filing an offer document if an SME undergoes a major promoter change exceeding 50% ownership. |

|

Lock-In Period for Promoters |

Minimum promoter contribution - 20% of post issue capital is locked-in for 3 years. |

|

Monitoring Agency |

Appointment of a monitoring agency is mandatory if issue size exceeds Rs. 50 crores. |

|

If Monitoring Agency is not Mandatory |

1 Certificate of Statutory Auditor (along with quarterly financial statement filing with SME exchange) for fund utilisation. 2 Certificate of Statutory Auditor (along with quarterly financial statement filing with SME exchange) for fund utilisation where working capital is > than 5 crores as an object of issue. |

|

Public comments on DRHP |

SME IPO DRHP requires a 21-day public review, newspaper advertisements (within 2 days of filing DRHP), and a QR code for seamless investor access. |

The amount for General Corporate Purposes, as mentioned in objects of the Issue in the draft offer document and the offer document shall not exceed 15% or Rs 10 crore, whichever is lower of the amount raised by the Issuer. The amount year marked for GCP can be used for Brand building, Marketing activities and Hiring human resources.

Further, the aggregate amount for General Corporate Purposes (GCP) and Unidentified acquisition shall not exceed 25% of the amount raised by the Issuer.

Yes, all securities held by promoters must be in dematerialized form. Learn more about Pomoters amd Promoter's Group here

The eligibility criteria for SME IPO states that the company must have positive FCFE for at least two out of the last three financial years for listing on NSE Emerge platform of India. Calculate your FCFE Ratio for SME IPO Eligibility.

The post-issue paid-up capital should not exceed Rs 25 crores.

The company must have at least 3 full financial years of track record of business to list on NSE Emerge or BSE SME stock exchanges of India.

Net worth is the sum of paid up capital and reserves and surplus appearing in the balance sheet of a company. The eligibility criteria require the net worth to be at least Rs 3 crores for SME IPO for NSE Emerge. BSE SME listing requirement states that the net worth shall be Rs 1 crore for preceding two full financial years.

The company must have operating profits or EBITDA of at least Rs 1 crore for two out of the last three financial years. There is no threshold for turnover though.

As per BSE SME IPO eligibility and listing requirements debt should not exceed three times the equity. Hence, leverage ratio shall not be more than 3:1

Dematerialization refers to conversion of physical shares into digital and electronic form. This is done by RTA (Registrars to IPO)

Entities or individuals debarred from accessing the capital market, wilful defaulters, fraudulent borrowers, or fugitive economic offenders are not eligible.

Yes, the company can apply to multiple exchanges but must select one as the designated stock exchange whether BSE SME or NSE Emerge.

0 Comments