Emerging Sector Outlook: Key Trends in India’s IPO Market

IPOs play a crucial role in fostering economic growth by providing companies with the capital needed for expansion and innovation. In India, the IPO market has seen significant growth, particularly in emerging sectors. As these sectors evolve, they attract substantial investments from investors, which drives innovation, generates employment, and enhances productivity.

In India’s growing IPO market, emerging sectors are increasingly contributing to the country’s economic development.

As the Indian economy continues its upward trajectory, several emerging sectors present exciting opportunities for IPO investments. These sectors are not only driving innovation and development but are also playing a significant role in the overall economic growth of the country. Here are the top 2 Emerging sectors to watch for IPO in India:

- Solar

- Agriculture (Agro)

The Renewable and Solar sectors are witnessing rapid growth, fueled by increasing global demand for clean energy, government incentives, and cost reductions in renewable technologies. IPOs in solar energy, recycling, and bio-waste are drawing strong investor interest, enabling companies to scale operations, adopt advanced technologies, and contribute to sustainability. With rising ESG-focused investments and corporate adoption of renewable energy, these sectors present significant opportunities. Upcoming SME and mainboard IPOs in solar panels, wind energy, and bioenergy will shape India’s clean energy future. Investors looking for long-term growth and sustainability-driven portfolios should closely watch these emerging sectors in 2025.

Renewable (Green Energy) IPO

The Renewable sector has emerged as a key driver of sustainable growth, attracting strong investor interest through IPOs. These public offerings provide companies with the necessary capital to expand. Waste Solutions, wind, hydro, and bioenergy projects, accelerating India's transition to clean energy.

Over the years, the sector has witnessed significant growth, with IPOs helping companies scale operations, adopt new technologies, and reduce dependency on fossil fuels. This trend not only supports energy security and environmental sustainability but also boosts job creation, infrastructure development, and economic progress.

With increasing government support and global interest, IPO in renewable sector are set to play a crucial role in shaping a greener and more resilient economy.

Renewable Sector is divided into two key sub sectors;

- Power and Energy

- Recycling

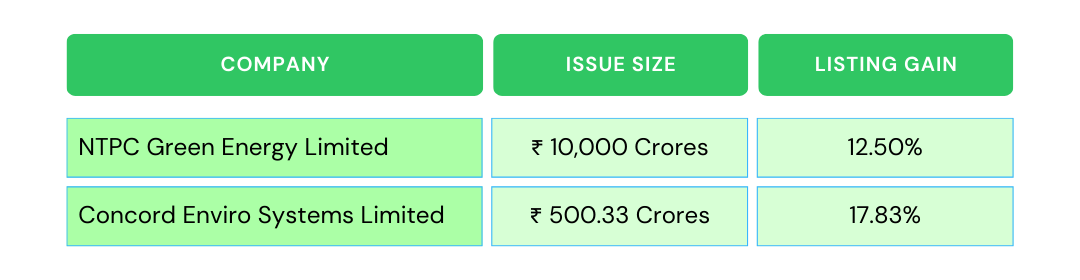

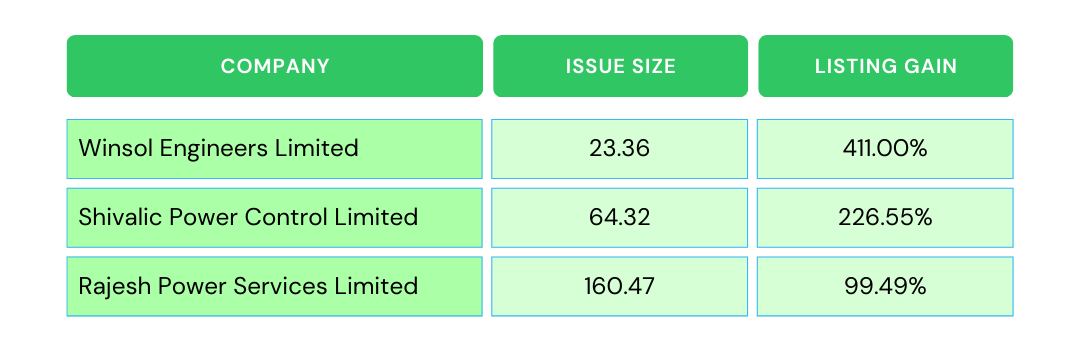

Best IPO in Renewable Sector

In 2024, several standout Renewable IPOs in India have garnered strong investor interest, supporting growth and innovation.

Best IPO in Renewable sector

List of Mainboard IPOs:

List of SME IPOs:

Upcoming IPO in Renewable Sector in 2025 (SME and Mainboard)

Upcoming IPOs in Renewable sector reflect growing sectors like Recycling, Power and Energy, and Bio waste, with investors watching for opportunities in these fields.

These IPOs may be listed on BSE SME or NSE Emerge and Mainboard Platform of Stock exchanges of India.

(link to upcoming IPO)

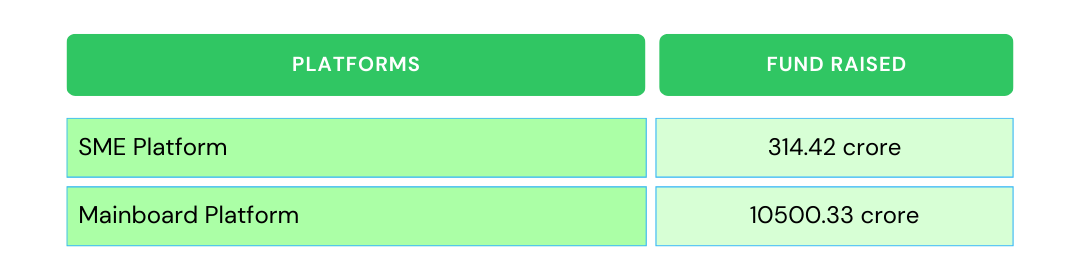

Total Funds Raised Through IPO in Renewable Sector (Primary Markets)

The renewable sector demonstrated robust fundraising activity in year 2024:

What to expect in the renewable sector IPO market?

Below are some key points to consider for the renewable-sector's outlook in the IPO market:

- Global Shift Toward Clean Energy- As governments and corporations worldwide commit to net-zero emissions and increasing reliance on renewable energy, companies in this sector are likely to be in high demand on the public markets.

- Government Policies and Incentives- Renewable energy companies are often supported by favorable policies, subsidies, and incentives. Many governments are setting ambitious renewable energy targets, offering tax credits, grants, and subsidies to encourage the development of clean energy solutions.

- Investor Sentiment and ESG Focus- Many institutional investors, including pension funds, are actively seeking opportunities in clean energy as part of their ESG strategies.

- Market Demand for Clean Energy Solutions-As the cost of renewable energy production continues to fall, demand for renewable energy solutions is rising across both the residential and commercial sectors.

Solar IPO for Emerging Sector

The Solar sector has grown rapidly, transforming India’s energy landscape with strong government support and technological advancements. From small projects to large-scale solar farms, it has reduced fossil fuel dependency, created jobs, and lowered electricity costs. Policies like subsidies and tax incentives have boosted investments, making solar energy a key driver of economic growth and sustainability.

The sector not only reduces dependency on fossil fuels but also creates jobs, boosts manufacturing, and lowers electricity costs, contributing to a greener and more self-reliant economy.

With rising demand for clean energy, the sector will continue to shape India’s green future.

Solar Sector is divided into two key sub sectors;

- Solar - Energy

- Solar – Panels

The solar sector plays an important role in renewable energy, with two key components: Solar Energy and Solar Panels. Solar energy harnesses sunlight to generate clean electricity, reducing reliance on fossil fuels and lowering carbon emissions. Solar panels are the core technology enabling this transformation, converting sunlight into power for homes, industries, and businesses. Together, they drive sustainability, energy independence, and economic growth, making solar a crucial part of a greener future.

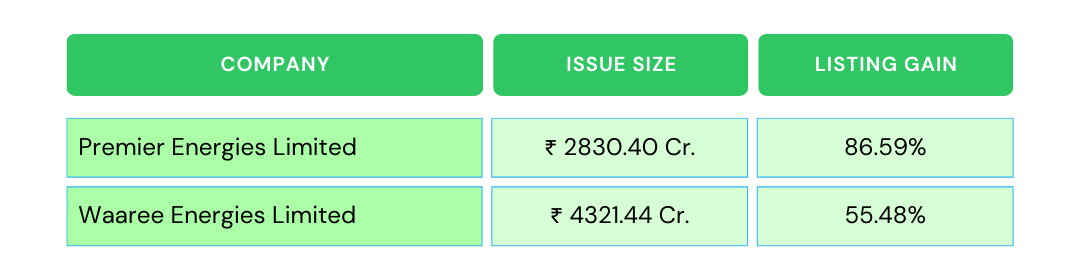

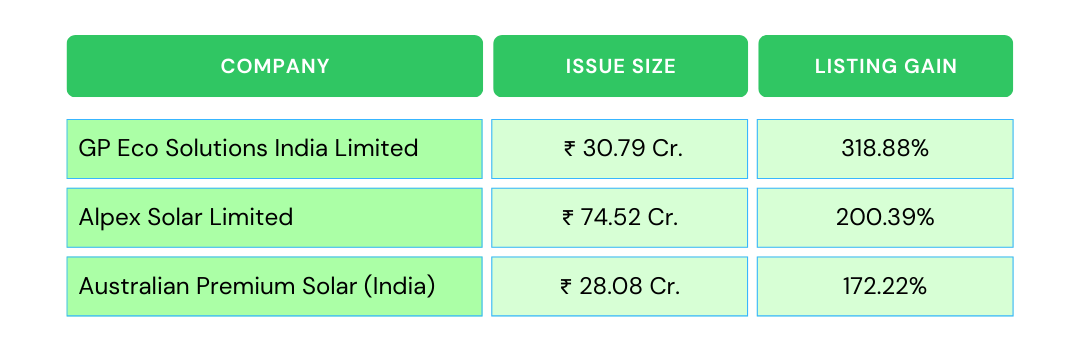

Best IPO in Solar Sector in 2024

In 2024, IPO in solar sector in India has garnered strong investor interest, supporting growth and innovation.

Best IPO in solar sector in 2024

List of Mainboard IPO

List of SME IPO:

Upcoming IPO in Solar Sector in 2025 (SME and Mainboard)

Upcoming IPOs in Solar sector reflect growing sectors like Solar-Energy, Solar-Panels with investors watching for opportunities in these fields.

These IPOs may be listed on BSE SME or NSE Emerge and Mainboard Platform of Stock exchanges of India.

(link to upcoming IPO)

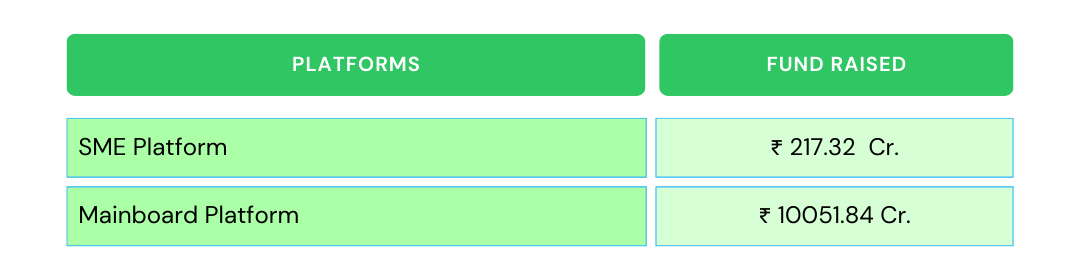

Total Funds Raised Through IPO in Solar Sector in primary markets

The IT sector demonstrated robust fundraising activity in year 2024:

Future outlook of Solar Sector

- Rising Corporate Adoption of Solar Energy- Large corporations are increasingly committing to 100% renewable energy, and many of them are relying on solar power to meet these goals.

- Growing Market Demand and Policy Support- The global shift toward renewable energy, especially solar power, has been accelerating. As governments commit to ambitious carbon reduction goals, including net-zero emissions, solar energy is set to be a significant part of the energy mix.

- Cost Reduction and Technological Advancements- The solar sector has experienced a significant reduction in costs due to improvements in manufacturing and technology, which makes it more competitive and profitable. These developments have positioned the sector for strong performance in IPOs.

- Companies that are developing cutting-edge solar technologies (e.g., solar storage solutions, bifacial panels, perovskite solar cells, and integrated solar solutions) are attractive IPO candidates due to their potential for long-term growth.

- Renewable energy funds are also investing heavily in solar energy, indicating a strong appetite for companies in this space. This trend is likely to extend to IPOs, where investors are looking for growth opportunities tied to the clean energy transition.

Conclusion for Famous IPO Category

Emerging sectors like renewable energy and solar offer substantial growth opportunities due to global trends like sustainability, digital transformation, and healthcare innovations. As these sectors evolve and mature, they can attract significant investor interest, making IPOs a viable route for companies looking to scale rapidly.

Overall, while emerging sector IPOs can present great growth potential, they require careful consideration of market conditions, the company's ability to scale, and the broader economic environment. For investors, these IPOs can provide opportunities to be part of cutting-edge industries that shape the future, but they must approach with due diligence and a long-term perspective.

Note: Please note that listing gains for mainboard IPO are calculated taking the listing price of BSE Exchange.

0 Comments