Benefits of SME IPO

Benefits of SME IPO

SME IPO platform offers a unique fund raise opportunity for small and medium enterprises seeking growth and visibility. Apart from enhancing the company’s profile, the process of listing is less stringent on SME platform than for the larger companies The Fund flow can be used for various purposes like expansion, repayment of debt, research and development and others. The benefits of SME IPO in India can be understood with the help of case studies below.

What role does IPO Advisors play in successful IPO?

IPO Advisors play an important role in successful launch of an IPO. Their advisory role from IPO readiness, selecting the best merchant banker in India for SME IPO, various due diligence activities and IPO valuation guides the company throughout the IPO Issue and listing process. IPO platform in India provides information on upcoming IPOs on NSE Emerge and BSE SME and list of merchant bankers and anchor investors. Role of IPO advisor is important in the success of the listings.

-

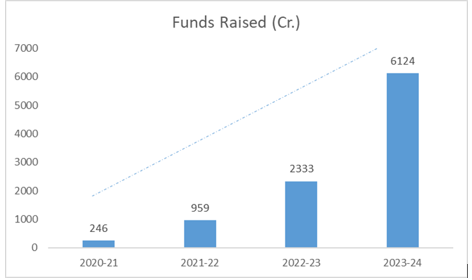

Fund Raise- SME Promoters in India can raise funds through listing on NSE or BSE SME platform. The fund raise can be utilized for expansion, new projects and acquisitions. Funds raised through equity saves financial cost if debt financing was used, hence lowers the debt burden. Fund raise also facilitates to repay the borrowings if any. The below chart highlights the rise in fund raise through SME IPOs over a period of time.

-

Organizational Structure- SME IPO Listing leads to better and timely disclosures making the Organization structure becomes more systematic and transparent. Strengthens the company’s management with improvements in corporate governance and operational practices.

-

Visibility and Brand Building- It is usually observed that market perception of the financials and the business of a listed company is enhanced. Hence it is an intangible benefit that can bring many tangible benefits from listing.

Case Study

Nupur Recyclers - The company is involved in importing, manufacturing, and trading of non-ferrous metal scraps such as shredded zinc scrap, zinc die cast scrap, and aluminum zorba grades. The company got migrated to Mainboard in January, 2023.

Observation- Since the listing of the company on the SME exchange in December 2021; the Market cap of Nupur Recyclers has grown ~5x. The company grew significantly with the fund infusion and also it migrated to mainboard on 12th Jan 2023.

-

Brings Investor Expertise- The Anchor Investors in India are very keen to invest in IPO of SME companies. Greater participation by anchor investors along with the funds bring their expertise and industry experience which benefits the listed company for a long term. Know who are the Anchor investors investing in SME IPOs. Anchor Investors Review link here

Unlocks the value of business and wealth creation- SME IPO Valuation in the market during the IPO process help the SME promoters to unlock their business value. Listing leads to wealth creation for promoters.

Case Study

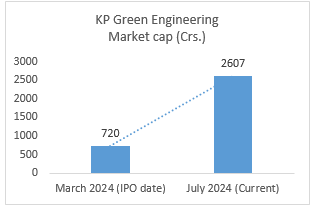

KP Green Engineering Limited- The company is engaged in the manufacturing of fabricated and hot-dip galvanized steel products. The product portfolio includes Lattice Towers Structures, Substation Structures, Solar Module Mounting Structures, Cable trays, Earthing strips, Beam Crash Barriers.

Observation- KP Green listed on March 2024; market cap has grown 3x after listing which shows how listing leads to wealth creation for the promoters by unlocking their business value.

-

Credibility- Listing opens other routes of Future fund raise. Further capital can be raised through various routes like preferential issue, rights issue, Qualified Institutional Placements. Debt can also be raised at economical rates for expansion purposes.

-

Migration to Mainboard- A company listed on NSE or BSE SME platform can migrate to Mainboard after three years of listing and on fulfilling certain eligibility conditions.

Case Study:

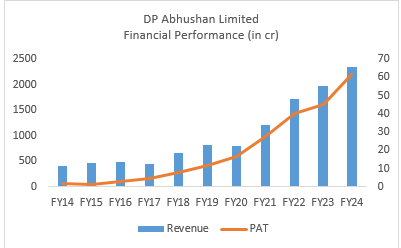

D P Abhushan Limited- The company is engaged in the retail business of various jewelleries and ornaments made out of gold, diamonds and platinum studded with precious and semi-precious stones.

The company has shown consistent growth in their post IPO financial performance in terms of its Revenues and Profits. Rise in its topline and bottomline can be understood from the chart below.

-

Pre-IPO Investment- Sometimes a company needs funds for growth before going for IPO. An IPO bound company can do a pre-IPO round to raise funds for growth and then go for IPO.

-

Other benefits- it includes approval required only from the stock exchange rather than SEBI approval. In listing, there is no loss of control and creates an exit option for existing investors.

0 Comments