Content

Introduction- SME IPO and listing requirements lay down the criteria for listing. SEBI ICDR Regulations (2018) also highlight the promoter and promoter group and their minimum promoter contribution. The chapter covers the meaning of promoter, MPC and lock in requirements of the promoter and promoter group. A list of promoter and promoter group is also shown as reference which forms part of DRHP in IPO.

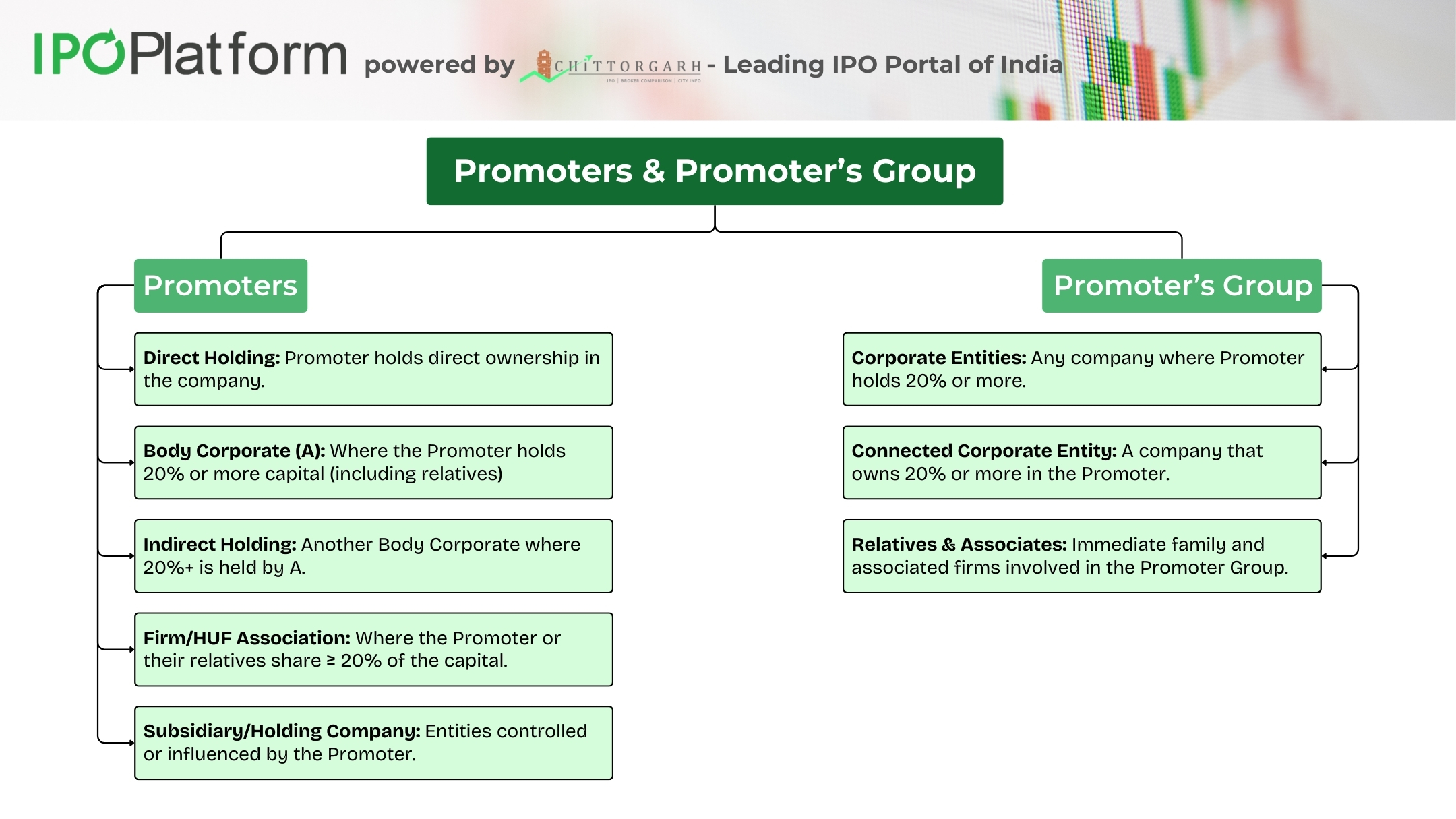

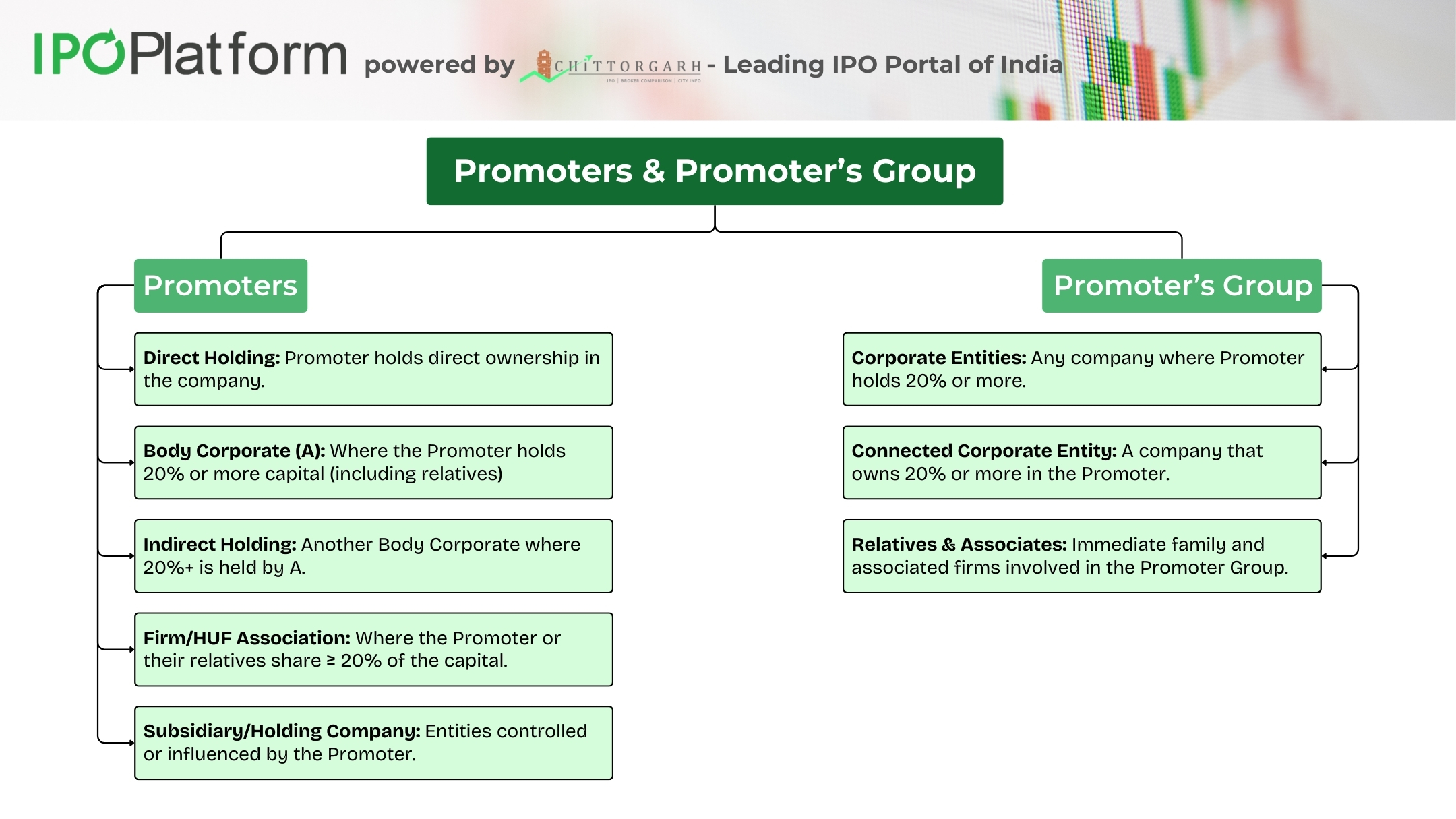

According to Regulation 2(oo) of the SEBI ICDR Regulations, 2018, Promoter includes:

i. Named as a promoter in Draft Offer Document (DRHP), Final Offer Document (RHP), or the company’s Annual Return under Section 92 of the Companies Act, 2013.

ii. A person who has direct or indirect control over the company's operations as a shareholder, director, or in any other capacity.

iii. Includes a person with whose advice, directions or instructions board of directors are accustomed to act.

If someone is working only in a professional role, does this rule apply to them?

Institutions like banks, mutual funds, venture capital funds, foreign investors, and insurance companies won’t automatically be called "promoters" just because they own 20% or more of a company's shares. They will only be considered promoters if they meet specific additional conditions set by the regulations. This ensures that investors who simply hold shares aren’t classified as promoters.

According to Regulation 2(pp) of SEBI ICDR Regulations, 2018, Promoter Group includes;

- The Promoter,

- An immediate relative of promoter (relative include spouse, child, brother, sister or any parent of the person or of the spouse).

- In case promoter is a body corporate;

- Subsidiary or holding company of that body corporate

- Any Body Corporate where the promoter holds 20% or more of the equity, or any Body Corporate that holds 20% or more of the promoter's equity.

- In case promoter is individual

- Any corporation where 20% or more of the equity is held by the promoter, their immediate family, or a firm or Hindu Undivided Family with such members.

- Any corporation where a body corporate, as described above, holds 20% or more of the equity.

- Any Hindu Undivided Family or firm where the promoter and their relatives collectively hold 20% or more of the total capital.

- All individuals whose shares are aggregated under the heading "shareholding of the promoter group"

Certain entities like financial institutions, scheduled banks, mutual funds, venture capital funds, alternative investment funds, foreign portfolio investors (excluding individuals, corporate bodies, and family offices), foreign venture capital investors, and insurance companies will not be considered part of the promoter group just because they own 20% or more of the promoter's equity.

However, these entities will be classified as part of the promoter group for any subsidiaries, companies they have promoted, or mutual funds they sponsor. This distinction ensures clarity about their role and involvement in the ownership structure.

2.2 Minimum Promoter Contribution

What is the meaning of Minimum Promoter Contribution?

According to Regulation 236 of SEBI ICDR Regulations, 2018;

-

Minimum Promoter Shareholding Requirement:

- The promoters must hold at least 20% of the post-issue capital.

- Exception: If the post-issue shareholding of the promoters is below 20%:

- Alternative investment funds, foreign venture capital investors, scheduled commercial banks, public financial institutions, and IRDAI-registered insurance companies can contribute.

- Non-individual public shareholders holding at least five percent of the post-issue capital can also contribute.

- Any entity within the promoter group (excluding the promoters themselves) may contribute.

- Following should be further noted:

- The contribution to cover the shortfall in minimum promoters' contribution is limited to a maximum of ten percent of the post-issue capital. These contributors will not be identified as promoters.

- Further Exception: The minimum promoters’ contribution requirement does not apply if the Issuer company has no identifiable promoter.

2. Forms of Promoters’ Contribution:

- Contribution Methods:

- Promoters shall contribute twenty percent, as stipulated in sub-regulation (1), either through equity shares or subscription to convertible securities.

- Condition: If the price of equity shares allotted upon conversion is not predetermined and not disclosed in the offer document, promoters shall only contribute through subscription to convertible securities in the public offer and must commit in writing to subscribe to the equity shares upon conversion of such securities.

- Compliance Timeline:

- Promoters must fulfill these requirements at least one day before the opening of the issue.

- Escrow Account:

- If promoters subscribe to equity shares or convertible securities for the minimum promoters’ contribution, the amount must be held in an escrow account with a scheduled commercial bank. This amount will be released to the issuer along with the issue proceeds.

- Condition: If the promoters’ contribution has already been provided and used, the issuer must include a cash flow statement detailing the use of these funds in the offer document.

What are the Securities ineligible for minimum promoters’ contribution?

According to Regulation 237 of SEBI ICDR Regulations, 2018,

1. For calculating the minimum promoters’ contribution, the following specified securities are excluded:

A. Securities Acquired in the Last Three Years:

- Non-Cash Transactions: Securities acquired through consideration other than cash, involving asset revaluation or capitalization of intangible assets.

- Bonus Issues: Securities resulting from a bonus issue using revaluation reserves or unrealized profits, or bonus issues against equity shares that are ineligible for minimum promoters’ contribution.

B. Securities Acquired at a Price Lower than the Issue Price preceding one year from opening of the Issue:

- Securities acquired by promoters, investment funds, banks, public financial institutions, insurance companies, or major non-individual shareholders in the past year at a price lower than the public offer price are ineligible.

- Above regulations does not apply to the following:

- If the difference between the acquisition price and the Issue price is paid to the Issuer.

- If the securities are acquired under a scheme approved by a High Court, tribunal, or Central Government under the Companies Act, 2013, for business and invested capital existing for more than one year prior to approval.

- Securities related to an initial public offer by a government company, statutory authority, corporation, or special purpose vehicle in the infrastructure sector.

- Equity shares arising from the conversion or exchange of fully paid-up compulsorily convertible securities held for at least one year prior to the draft offer document, provided full conversion terms are disclosed.

Explanation:- The price per share for determining securities ineligible for minimum promoter contributions shall be determined after adjusting the same for corporate action such as share split, bonus issue, etc. undertaken by the Issuer.

C. Securities Acquired by Issuer Formation:

- Securities acquired by promoters during the preceding year at a price lower than the issue price, in cases where the issuer was formed by converting partnership firms or limited liability partnerships, with no change in management.

- Exclusions: Securities allotted to promoters against existing capital in such firms for over a year continuously shall be eligible.

D. Pledged Securities:

- Specified securities pledged with any creditors.

2. Specified securities referred to in clauses (a) and (c) above are eligible for minimum promoters’ contribution calculation if acquired pursuant to a scheme approved under the Companies Act, 2013 or any prior company law.

2.3 Lock-in Requirements

Lock-in of specified securities held by the promoters

Regulation 238 of SEBI ICDR Regulations (2018) specify the following with respect to lock-in requirements of promoters related to IPO purposes.

-

Lock-In Period for Minimum Promoters' Contribution:

- Coverage: Includes contributions from:

- Alternative investment funds

- Foreign venture capital investors

- Scheduled commercial banks

- Public financial institutions

- Insurance companies registered with the Insurance Regulatory and Development Authority of India (IRDAI)

- Non-individual public shareholders holding at least 5% of the post-issue capital

- Entities (individual or non-individual) in the promoter group, other than the promoter(s)

-

Lock-In Duration: Three years from the date of:

- Commencement of commercial production, or

- Date of allotment in the initial public offer (IPO), whichever is later.

-

Lock-In Period for Promoters' Excess of MPC Holdings:

- Coverage: Promoters' holdings exceeding the minimum promoters' contribution.

- Lock-In Duration: As per the recent amendments excess of MPC requirement is-

- 50% released after one year

- Remaining 50% to be released after 2 years.

Lock-in of specified securities held by persons other than the promoters:

Regulation 239 of SEBI ICDR Regulations (2018) specify the following with respect to lock-in requirements of persons other than the promoters related to IPO purposes.

All pre-issue capital held by individuals other than the promoters is locked-in for a period of 1 year from the date of allotment in the initial public offering (IPO).

Provided that nothing contained in this regulation shall apply to:

- Equity shares allotted to employees—Equity shares allotted to employees (regardless of whether they are current employees or not) under an employee stock option plan (ESOP) or employee stock purchase scheme (ESS) or a Stock appreciation right Scheme of the Issuer before the IPO, provided that the Issuer has fully disclosed details about such options or schemes in accordance with Part A of Schedule VI (schedule VI shows a list of disclosures to be made in the DRHP)

- Equity shares held by an employee stock option trust or transferred to employees by such a trust following the exercise of options, whether the employees are currently employed or not, under the employee stock option plan or employee stock purchase scheme. These equity shares allotted to employees will be subject to lock-in provisions as specified in the Securities and Exchange Board of India (Share Based Employee Benefits and Sweat Equity) Regulations, 2021.

- Equity shares held by a venture capital fund, an alternative investment fund of Category I or Category II, or a foreign venture capital investor: Provided that such equity shares shall be locked-in for a minimum period of one year from the date of purchase by the venture capital fund, alternative investment fund, or foreign venture capital investor.

Following points needs to be considered for Calculating the Lock in Requirements

- Eligibility for Computation: The locked-in equity shares comply with Regulation 237 of the SEBI ICDR Regulations. They do not include shares acquired for non-cash consideration, from asset revaluation, or as bonus shares from reserves.

- Acquisition Price: The shares are not acquired at a price lower than the public offer price, ensuring they meet the promoter’s contribution criteria.

- No Encumbrances: The equity shares for the promoter’s contribution are free from pledges or encumbrances.

- Consent and Contribution: Specific written consent from the promoters has been obtained for including the equity shares in the lock-in period. The minimum promoter’s contribution is correctly accounted for.

This structured lock-in approach ensures the commitment of promoters and key investors, aligning with SEBI regulations and reinforcing investor confidence in the company’s long-term stability.

Here is the list of promoter and promoter group for reference which forms part of DRHP

|

Name of Promoter

|

Designation

|

|

Promoter 1

|

Managing Director

|

|

Promoter 2

|

Whole Time Director

|

|

Promoter 3

|

Director

|

|

Promoter 4

|

Director

|

Following are the Documents required for promoters in IPO process

1. Permanent Account Number (PAN)

2. Aadhar Card

3. Passport Number

4. Driving License

5. Last 3 year ITR report

6. Qualifications Details

7. Experience

8. Shareholding details etc.

Who can form part of the Promoter Group?

-

As Individual and their relation with promoters

- Father

- Mother

- Spouse

- Brother(s)

- Sister(s)

- Son(s)

- Daughter(s)

- Spouse’s Father

- Spouse’s Mother

- Spouse’s Brother(s)

- Spouse’s Sister(s)

-

Following are the Documents required for promoters in IPO process;

- Permanent Account Number (PAN)

- Aadhar Card

- Passport Number

- Voter Id

- ITR Returns if filed

It is to be noted that the documents so asked for are only for verification purposes for merchant bankers and such personal details are not published in any document.

-

Body Corporates

- Any company where the Promoters and their immediate relatives, or a firm/HUF they are involved in as partners or proprietors, holds 20% or more shareholding.

- Any company in which a company mentioned above holds 20% or more of the total shareholding.

- Any HUF or firm where the Core Promoter or their immediate relatives hold 20% or more stake.

- Any Subsidiaries or Holding company of that company

- Any company where the core promoter owns 10% or more of the shares, or a company owns 20% or more of the promoter's shares. In short, the promoter has a significant shareholding.

- Any company where a group of people or companies own 20% or more of its shares, and they also own 20% or more of the shares in the company issuing those shares

-

Some documents required are

- Annual Filing (Roc Filings)

- Updated List of Shareholders

- Latest Financials

- Any other as required.

The above information is a part of common information requirements of promoter and promoter group. However, it may vary on a case to case basis.

0 Comments