Merchant Bankers in India have a crucial role to play in listing and IPO process. Merchant Bankers are also known as the Book running lead managers (BRLM). They are registered with SEBI and have merchant banking license. An IPO can have single or more than one merchant bankers. In a SME IPO, it is mandatory to underwrite the IPO by merchant banker, however in case of mainboard IPO, underwriting is not compulsory. Here in this chapter we have explained the regulations relating to merchant bankers, role and responsibilities of merchant bankers. It is very important to choose the best merchant banker for fund raise in primary markets for a long term wealth creation.

The role of Merchant Bankers in the SME IPO process is crucial to ensure the smooth execution of an Initial Public Offering (IPO) and compliance with regulatory frameworks. As per the SEBI (ICDR) Regulations, 2018, Merchant Bankers act as intermediaries between the Issuer and investors, facilitating the preparation, promotion, and management of the IPO process. Their responsibilities include preparing key documents such as the Draft Red Herring Prospectus (DRHP), determining the IPO valuation, ensuring legal compliance, managing marketing efforts, and assisting with post-IPO obligations. Merchant Bankers also play a significant role in guiding the Issuer through the regulatory approval process, structuring the IPO, and coordinating with other stakeholders to ensure the IPO is successfully completed. This comprehensive involvement requires expertise in capital markets, legal frameworks, and investor relations, making them an essential component in an SME’s journey to go public.

The agreement between the Issuer and the merchant bankers in India includes clauses to govern their relationship during the IPO process and listing. Key points include:

Merchant Bankers in India are financial institutions that serve as a bridge between companies seeking funds and investors looking to invest. According to SEBI (Merchant Bankers) Regulations, 1992, Merchant banker means any person who is engaged in the business of Issue management of IPO either by making arrangements regarding selling, buying or subscribing to securities or acting as manager, consultant, adviser or rendering corporate advisory service in relation to such issue management.

Merchant Bankers are broadly classified in 2 categories as per the amended Merchant Bankers Regulation, 1992 on the basis of net worth and activities:

|

Category |

Description |

Net Worth Requirement |

Permitted Activities |

|

Category I |

Comprehensive involvement in the full process of issue management. Certified by SEBI as top-tier. |

Rs. 50 Crores (minimum) |

Issue management, underwriting, portfolio management. |

|

Category II |

Focus on advisory, consulting, and management services for IPOs. |

Rs. 10 Crores (minimum) |

Advisory, consulting, and IPO management (excluding Main Board equity issues). |

Category I Merchant Bankers: This is the most comprehensive category, where firms are involved in the full process of Issue management. They also act as underwriters and portfolio managers. Category I is the top tier merchant bankers in India certified by SEBI. Net worth of this category of merchant bankers shall not be less than Rs 50 crores.

Category II Merchant Bankers: Firms in this category provide advisory, consulting, and management services in IPO. Net worth shall not be less than Rs. 10 crores and allowed to undertake all permitted activities except managing equity Issues on the Main Board.

In the IPO process, several key intermediaries play a crucial role in ensuring the smooth execution of a company's public offering. Among these intermediaries are IPO Advisors and Statutory Auditors, both of which contribute significantly to the successful launch and compliance of an Initial Public Offering (IPO).

IPO Advisors are experts who guide companies through the complex IPO process, from selecting the right merchant banker to ensuring compliance with legal and regulatory requirements. They assist with crucial tasks such as preparing the Draft Red Herring Prospectus (DRHP), conducting due diligence, determining valuations, and marketing the IPO to attract investors. Their ongoing support post-IPO helps companies maintain compliance and manage investor relations.

On the other hand, Statutory Auditors ensure the accuracy and transparency of a company's financial statements, providing an independent review of its accounts. As per the Companies Act, 2013, every company must appoint a statutory auditor, who plays a key role in building trust with investors by verifying the financial health of the company before it goes public.

Together, these intermediaries help facilitate a successful IPO by providing expertise, ensuring regulatory adherence, and fostering investor confidence.

As per section 139 (1) of Companies Act,2013

Every company must appoint an auditor at its first annual general meeting (AGM), either an individual or a firm. This auditor will stay in office until the end of the company’s sixth AGM and will continue to serve for every sixth meeting after that. The process of selecting the auditor at the meeting will follow certain rules.

Before the appointment, the company must get the auditor’s written consent for the appointment, along with a certificate from the auditor confirming that the appointment meets required conditions. The certificate should also confirm that the auditor meets the criteria specified in Section 141.

After the appointment, the company must inform the auditor about their appointment and file a notice with the Registrar of Companies within 15 days of the meeting where the appointment was made.

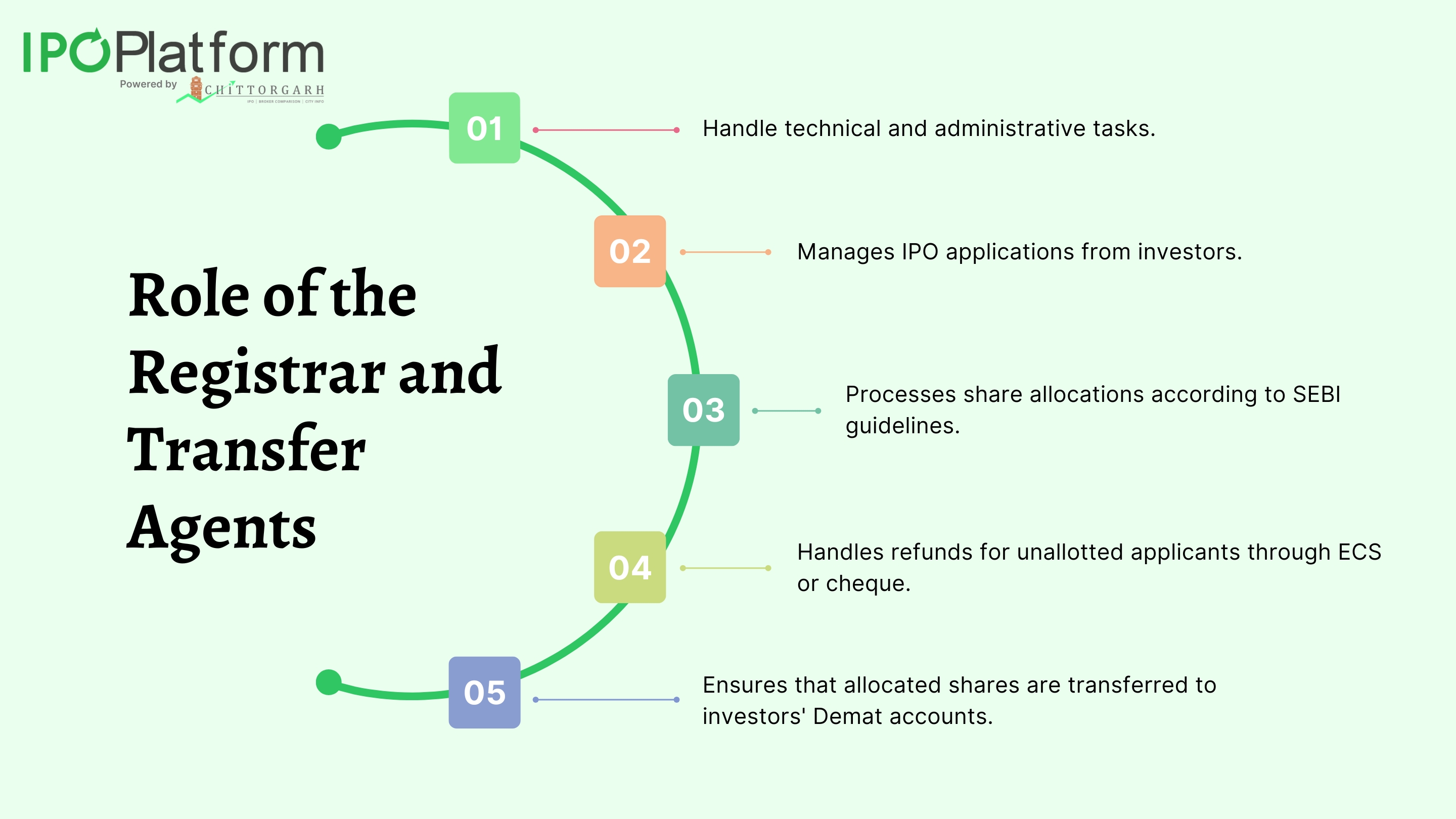

The Registrar to an IPO plays a vital role in ensuring the efficient processing and management of an Initial Public Offering (IPO). Appointed by the company issuing securities, the Registrar handles key administrative tasks, such as collecting applications from investors, maintaining records, determining the basis of allotment, and processing refunds. Additionally, they facilitate the transfer of shares to investors' demat accounts and issue important documents like allotment letters and refund orders. These responsibilities are crucial to ensure transparency and fairness throughout the IPO process.

To serve as an IPO registrar, the entity must be registered with SEBI and meet specific eligibility criteria, including having the necessary infrastructure, experience, and compliance with regulatory requirements. Importantly, a registrar cannot be associated with the company issuing the securities to avoid conflicts of interest and maintain impartiality.

Investors can reach out to the registrar directly for assistance with IPO-related queries, such as allotment status, refunds, or demat account issues. By ensuring that all transactions are handled smoothly, the Registrar helps make the IPO process more efficient for both companies and investors.

A Registrar to an IPO refers to the person or organization appointed by a company or group to handle specific tasks related to a securities offering. Their main responsibilities include:

In simple terms, the Registrar ensures that the entire process of collecting applications, allotting securities, and issuing related documents runs smoothly and efficiently.

IPO Registrars are independent financial institutions registered with stock exchanges and hired by companies which are going public. Their main role is to manage the records of the IPO and the ownership of shares.

The Registrar’s duties include processing IPO applications, allocating shares to investors according to SEBI rules, handling refunds, and transferring shares to investors’ demat accounts.

Investors can contact the Registrar for help related to the IPO, such as not receiving allotment letters, shares not being credited to their demat accounts, or refund problems.

The company issuing the securities (through an IPO, rights issue, etc.) appoints the registrar. The company can choose a registrar from a list of registered entities that are authorized by SEBI. Often, investment banks or underwriters handling the IPO might also recommend specific registrars based on their experience and capabilities. (list of registrars)

www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=10

The registrar must be a SEBI-registered entity with the necessary qualifications to handle securities transactions. The entity should have experience in handling large-scale applications, maintaining records accurately, and managing refunds and share allotments.

The registrar must also adhere to the rules and regulations prescribed by SEBI and the relevant stock exchanges to ensure transparency and fairness for IPO.

SEBI considers the following when granting a certificate of Registrar:

a) The applicant has the necessary infrastructure (office space, equipment, manpower) to effectively carry out activities.

b) The applicant has relevant past experience in the activities.

c) Neither the applicant nor anyone connected with them has been denied registration under the Act.

d) The applicant meets the capital adequacy requirements specified in regulation 7.

e) The applicant is not subject to any disciplinary proceedings under the Act.

f) Neither the applicant nor its directors, partners, or officers has been convicted of an offence involving moral turpitude or economic offences.

g) The applicant is deemed a fit and proper person.

No, a registrar to the Issue cannot act as the registrar for a company if they are considered an "associate" of that company.

According to the rule 13A of SEBI (Registrars to an Issue and Share Transfer Agents) Regulation, 1993, a registrar is considered an "associate" of the company if:

1. The registrar or the company has control of at least 10% of the voting power in the other party. This means if the registrar or the company issuing securities owns a significant stake (at least 10%) in each other, they cannot act together on an issue.

2. If the registrar or any of their relatives are directors or promoters of the company issuing the securities (or vice versa), they are also considered associates, and thus the registrar cannot act for that company.

This rule is in place to maintain fairness and prevent any conflict of interest. It ensures that the registrar remains independent and unbiased in handling the IPO or any securities issuance.

Yes, investors can contact the registrar for inquiries related to their IPO applications, allotment status, refund processes, or Demat account transfers. Typically, the contact details of the registrar are made available in the Prospectus or Offer Document of the IPO.

The registrar provides helpdesk services for investors to resolve any issues they may face during or after the application process.

Introduction- The Compliance Officer plays a vital role in ensuring the company adheres to all legal, regulatory, and procedural requirements during the IPO process. They ensure compliance with guidelines set by regulatory authorities like SEBI and stock exchanges, oversee the accuracy and timeliness of mandatory filings such as the Draft Red Herring Prospectus (DRHP) and Red Herring Prospectus (RHP), and act as the primary liaison with regulators.

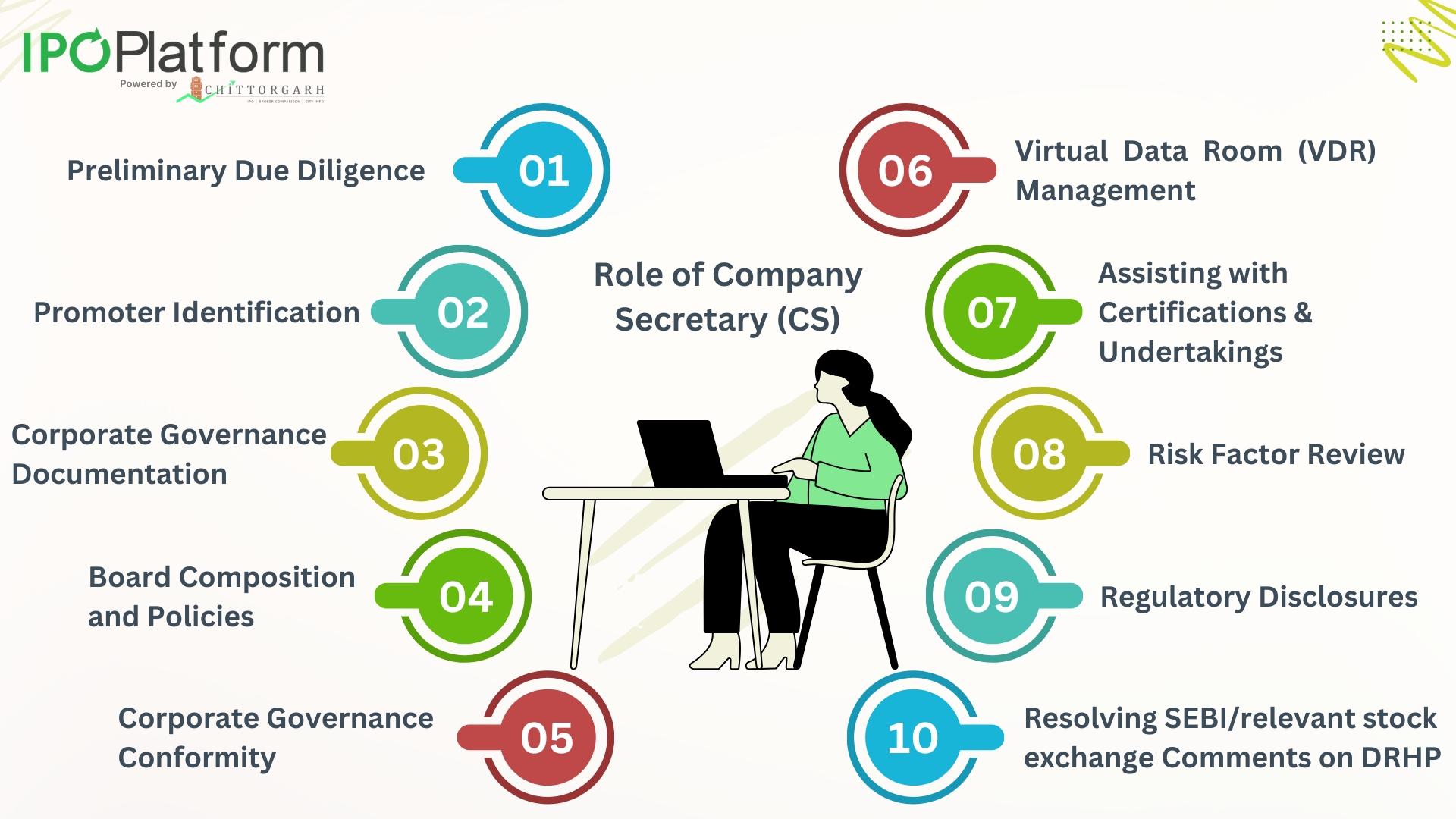

It is to be noted that full time (in house) Company Secretary and Chief Financial Officer (CFO) has to be appointed before filing DRHP for IPO and to comply with the listing requirements. The CS can then directly coordinate with other intermediaries like Registrars (RTA), Bankers and merchant bankers at the time of allotment and listing of shares.

Their proactive role helps mitigate legal risks and ensures a smooth and transparent IPO process.

In the IPO process, the Company Secretary (CS) plays a pivotal role in ensuring legal and regulatory compliance and guiding the company through a smooth transition to a public listing. Key responsibilities of the CS include:

Through these steps, the CS ensures that all legal, governance, and regulatory aspects of the IPO process are handled meticulously, facilitating a successful public offering and smooth transition to a listed entity.

After the completion of IPO and completion of listing, a listed company has to comply with LODR (Listing Obligations and Disclosure Requirements) requirements as stated below:

It shall also be noted that appointment of Company Secretary is applicable as per the below regulations:

Under Section 203 of the Companies Act, 2013, read with Rule 8 and Rule 8A of The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014:

The Company Secretary (CS), particularly in listed entities, plays a critical role in ensuring regulatory compliance and effective governance. Their primary responsibilities include:

Ensure that the listed entity adheres to all applicable regulations in letter and spirit, maintaining the integrity of compliance processes.

IPO Advisors like IPOPlatform.com assist with valuation, documentation, regulatory approvals, merchant banker selection, and investor outreach, ensuring smooth listing and successful fundraising. Their expertise helps companies navigate SEBI compliance, market positioning, and post-listing strategies.

Intermediaries are the most important part of an IPO process. Lead managers, IPO Advisors, Registrar (RTA) to the Issue, Compliance Officer (Company Secretary) are the financial intermediaries in IPO Process.

Major merchant bankers in India for SME IPO includes Hem Securities, GYR Capital Advisors, Holani Consultants and others. Mainboard Merchant Bankers includes SBI Capital Markets, Kotak Mahindra Capital and ICICI Securities

The lead manager in charge of underwriting must fulfill underwriting obligations and notify underwriters of their responsibilities as per regulations.

The company issuing securities appoints the Registrar, often recommended by investment banks or underwriters.

Investors can contact the Registrar directly for assistance with allotment status, refund issues, or Demat account transfers

A listed company must comply with SEBI’s Listing Obligations and Disclosure Requirements (LODR) and it is usually handled by the in-house qualified Company Secretary as the Compliance Officer.

0 Comments