Role of IPO Advisors in IPO Listing and Pre IPO Process

Initial Public Offer is a way of fund raise for a company to meet their growth and expansion needs. IPO and listing means listing of a company on NSE and BSE, stock exchanges of India. Now a small and medium company can also get listed on NSE SME or BSE SME platform. SEBI, NSE Emerge and BSE SME have specified certain eligibility criteria which need to be adhered to for making a company public. There is a IPO process as laid down under SEBI ICDR regulations and this process involves intermediaries who work in coordination to list a company. Various intermediaries involved in the process are Merchant Bankers in India, IPO Advisors, IPO Consultants, Registrars (RTA) and Banks.

In this blog, let’s understand the role of IPO Advisors in IPO.

Who are IPO Advisors?

IPO Advisors are key partners in the IPO process. IPO and listing is quite a complex process for the business promoters, here IPO Advisors play an important role to handhold the promoters in entire IPO journey while business owners can focus on scaling their business. They provide expert guidance to ensure a successful public offering.

Structuring the IPO- IPO advisors assist in choosing the right merchant banker or lead manager, due diligence process, peer review audit and other compliances and documentation. IPO Advisors role also includes post issue compliances in some cases.

PRE IPO Requirements- Pre IPO funding is also handled by IPO consultants and then until listing, they advise the company on various perspectives.

Market Expertise-Their market expertise and strategic advice help mitigate risks, optimize timing, and attract the right investors, ultimately maximizing value for the company and its shareholders.

Why Are IPO Advisors important in the IPO Process?

IPO Consultants play a very important role in helping companies guiding through the complex process of going public. They offer expert advice on key decisions like structuring the IPO, IPO valuation, and ensuring all legal and regulatory requirements are met. Their experience in preparing key documents, like the IPO prospectus (DRHP), helps build trust with investors by providing clear and accurate information about the company’s financials and operations.

Additionally, IPO advisors help with marketing the IPO to potential investors. They also provide ongoing support after the IPO, ensuring the company maintains strong investor relations and complies with ongoing regulatory requirements. In short, IPO advisors are essential for making the process smoother, more efficient, and successful IPO.

Why Choose an IPO Advisory Firm?

IPO advisory firms are your trusted partners in the IPO journey. They provide the expertise you need throughout the complex process, ensuring your company is ready for the public market.

If any company is thinking about going public, working with an IPO advisory firm may be one of the fair decisions for a prospective IPO company for long term.

An IPO Advisory firm also keeps the data confidential and discusses the case with limited best merchant bankers to maintain the confidentiality and avoiding any negativity in the market.

How IPO advisory firms helps companies in the process of IPO?

IPO advisory firms play a vital role in guiding companies for the right time to go public and guiding through the IPO process. These firms bring a wealth of expertise to help ensure the IPO is successful, smooth, and compliant with all regulations. Here's how they assist:

1. Strategic Planning and IPO Structure

IPO advisory firms work with companies to determine the best way to structure their IPO. This includes advising on the number of shares to issue, IPO valuation, IPO size and the timing of the IPO. Their experience helps companies to make informed and better decisions to maximize the success of the offering and raise the required capital.

2. Regulatory Compliance and Legal Support

Going public means adhering to the rules and regulations. IPO advisors help companies meet the all the legal and regulatory requirements set by SEBI and Stock exchanges. They ensure that all documentation, such as the DRHP, is complete and accurate, helping the company to avoid legal complications.

3. Due Diligence and Financial Preparation

Before a company can go public, it must undergo a detailed review of its financials, operations, legal matters, and secretarial records. IPO advisory firms help conduct this due diligence to ensure that the company's financial statements are accurate, transparent, and comply with all required regulations. This helps in building investor trust and confidence.

4. Preparing the Prospectus and Key Documents

It is one of the most important tasks in an IPO process to creating the prospectus called DRHP (draft red herring prospectus). It is a detailed document that provides all the information about the company to potential investors which they need to make an informed decision. IPO advisory firms help draft this document, which includes financial statements, business strategies, objects of the offer, shareholding patterns, capital structure, and risk factors. A well-drafted prospectus is very important for attracting investors and ensuring the success of IPO.

Read Our Detailed Blog on "What is DRHP?"

5. IPO Pricing and IPO Valuation

IPO Valuations and IPO Pricing is one of the most crucial process of the IPO. Book Running lead Managers have the role to decide on the IPO valuation based on various factors. IPO advisors assist companies in arriving at fair valuations based on market conditions, the company’s valuation, and investor demand. Fair valuations ensure the company raises the desired capital while also making the public offer appealing to the potential investors.

Read Our Detailed Blog on "Why Fair Valuation is Important?"

6. Marketing the IPO and Investor Relations

IPO advisory firms assist with marketing the IPO along-with lead managers in organizing roadshows and investor meetings where the company’s executives can pitch the business to potential investors. They help build awareness and excitement for the IPO, ensuring that the offering attracts the right level of interest from institutional and retail investors.

7. Post-IPO Support

IPO advisory firms provide ongoing support to the company after the listing also by assisting in post Issue compliances. They help manage relationships with investors, ensure compliance with post-IPO reporting requirements, and offer strategic advice to help the company perform well in the public markets. This ongoing support is crucial for maintaining a strong market presence and achieving long-term success.

Let’s understand how an IPO Advisor would help with the help of an example:

Example

Let’s consider a company named ABC Pvt. Ltd., engaged in steel manufacturing incorporated in year 2018 and is looking to go public.

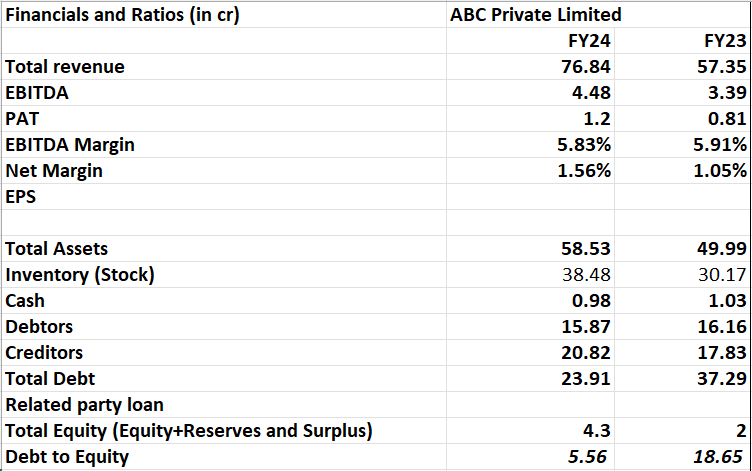

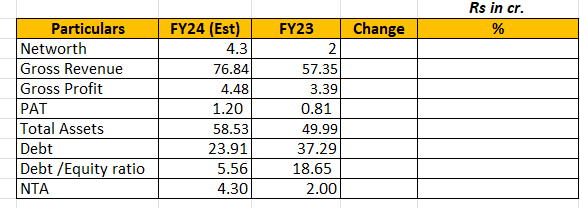

Following Information:

On the basis of the above Imaginary financials, IPO advisors would assess the eligibility for the IPO as per the current SEBI ICDR regulations. In the above example one can see the assessment below:

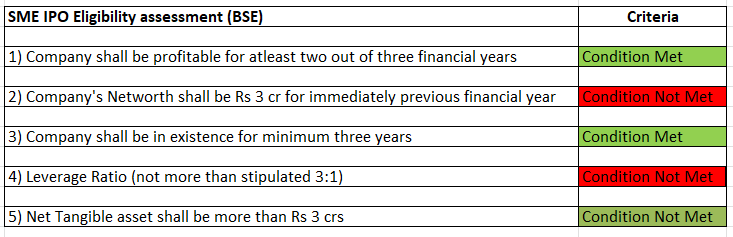

Eligibility check for IPO of ABC Private Limited

Here, it can be understood that ABC Ltd is ineligible on the criteria for Net worth and Leverage Ratio. So, the IPO advisors would advise accordingly to fulfil the eligibility criteria and may suggest some ways to do it.

However, As per the new SEBI consultation paper the eligibility criteria may be revised and company would have to comply with new eligibility norms.

What factors can lead to IPO Readiness?

The IPO advisors would analyze these figures and guide ABC Pvt. Ltd. on improving its financials and operations to meet the eligibility criteria for listing. Here’s what they may suggest:

- Key Management Salary: IPO advisors may offer to reduce excessive salary payments to directors. High salaries can sometimes indicate that a company is not using its resources efficiently. They would advise aligning salaries with industry standards to ensure the company appears financially disciplined.

- Minimize Fictional Expenses: The advisors would advise the company to ensure that it is not overstating expenses that do not impact its cash flows, such as unnecessary write-offs or adjustments, which can make the company appear less profitable than it actually is. This will help reflect a more accurate picture of profitability.

- Pay Proper Tax Liability: The company must ensure that all tax liabilities are paid in full. Advisors will suggest streamlining the tax management process, ensuring compliance, and avoiding any liabilities that could affect the company's credibility with investors.

- Strengthen Financial Statements: Advisors would guide the company in making its financial statements clear, accurate, and transparent. The balance sheet and profit and loss statements need to show real and sustainable profits, not inflated numbers. A strong financial record is crucial for attracting investors.

By implementing these changes, the company would increase its credibility and prepare for IPO. The advisors would help the company restructure its finances and operations to ensure it is in the best possible position to be considered for a public offering.

What are the Eligibility Criteria for Listing on SME BSE/NSE Emerge?

To be eligible for listing on the SME platforms like BSE SME or NSE Emerge, below are the basic eligibility criteria:

- Net Worth: The company must have a net worth of at least Rs 3 crores.

- Track Record: It should have a track record of business for at least three financial years.

- Profitability: Companies should have positive operating profits for at least the last two years.

- Leverage Ratio- Not more than 3:1

- Net Tangible Assets to be Rs 3 crores.

Refer detailed eligibility criteria of BSE SME and NSE Emerge here.

What is right time to bring an IPO after meeting the Eligibility criteria?

Once the company follows the IPO advisor’s guidance and works on improving its financials, reducing operational inefficiencies, and meeting all regulatory compliance requirements, the timeline for bringing the IPO could be between 5 to 7months, depending on the improvements made and market conditions.. After the necessary approvals and preparations (such as selecting a Merchant Banker and preparing the prospectus), the company can go public within a few months.

In summary, IPO advisors would help ABC Pvt. Ltd. improve its financials, reduce unnecessary expenses, and ensure compliance, thereby assisting it in IPO eligibility and readiness and valuations for a successful IPO. By taking the right steps now, the company can aim for an IPO in the near future, potentially raising funds and scaling its business.

Conclusion

In conclusion, IPO advisors play an integral role in the IPO process, offering invaluable expertise and guidance to companies navigating the complex journey of going public. Their responsibilities encompass strategic planning, ensuring regulatory compliance, managing financial preparation, and assisting with pricing and market timing. By preparing the necessary documents, such as the DRHP, and facilitating investor relations, IPO advisors ensure the company is well-positioned to attract the right investors and secure optimal capital.

From pre-IPO to post-IPO support, their role extends beyond the initial offering, helping maintain strong governance, investor confidence, and continued market success. Whether for SMEs or larger enterprises, IPO advisors significantly increase the likelihood of a successful IPO on mainboard platform or on BSE SME or NSE Emerge by managing risks, ensuring compliance, and strategically positioning the company in the market. With their expertise in assessing eligibility criteria by SEBI, IPO pricing, timing, and IPO valuation, IPO advisors are essential partners for companies looking to maximize their potential in the public market.

1 Comments