IPO Valuation- Why is fair valuation important?

IPO valuation plays an important role in the process of IPO. The valuation of the company during IPO determines the IPO size of a company. Fair valuation of an IPO bound company is quite a complex process that involves assessing the potential value of a company going public. IPO pricing is one of the processes handled by the merchant bankers in India, also known as the underwriters.

Overvaluation or undervaluation at IPO stage could affect the performance of the stock after listing over a period of time.

How does IPO valuation work?

An overvalued company is a company valued higher than its potential. Overhype and overvaluation is a significant downside for a company at IPO stage as the company’s IPO price may not reflect the company’s intrinsic price. An overvalued IPO might be able to garner short term profits but might not be good for a long term perspective. In long term, an overpriced valued IPO stock may result in correction in its price thus affecting the market cap.

In an underpriced IPO, the IPO price is set below its market value. IPO price is set conservatively to attract more investors. Sometimes it may be the reason that the underwriter underestimates the demand of a company’s share though it’s of rare possibility. However, the underpriced scenario might not be viable and the company’s stocks will adjust to their actual value.

What role does IPO Advisors play in successful IPO?

IPO Advisors play an important role in successful launch of an IPO. Their advisory role from IPO readiness, selecting the best merchant banker in India for SME IPO, various due diligence activities and IPO valuation guides the company throughout the IPO Issue and listing process. IPO platform in India provides information on upcoming IPOs on NSE Emerge and BSE SME and list of merchant bankers and anchor investors. Role of IPO advisor is important in the success of the listings.

Why is fair valuation important for IPO?

Hence, the optimal valuation or the Fair Valuation of an IPO is of utmost importance that reflects the true intrinsic value of the company. Fair valuation provides a clearer and accurate picture of a company’s financials, assets and liabilities.

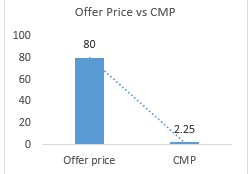

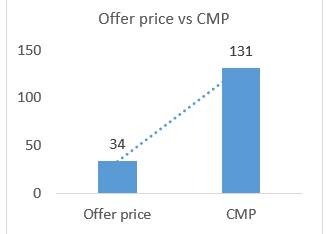

Here we have given a case study to understand the fair valuation:

|

Company |

Ameya Precision Engineers Limited

|

|

|

IPO Date

|

01 September 2022

|

01 September 2022

|

|

Sector

|

Engineering

|

Engineering

|

|

PE

|

16.75x (Fairly Valued)

|

38.09x (Overvalued)

|

|

Annualized Revenue

|

Rs 23.96 Crs.

|

Rs 21.74 Crs.

|

|

Annualized PAT

|

Rs 1.52 Crs.

|

Rs 1.27 Crs.

|

|

Merchant Banker |

||

|

Offer price

|

Rs 34

|

Rs 80

|

|

Listing Price |

Rs 65.4 (+92.35%)

|

Rs 82.8 (+3.5%)

|

|

Current Market Price |

Rs 131 (+285.29%)

|

Rs 2.25 (-97%)

|

|

M cap (IPO)

|

Rs 25.5 Cr

|

Rs 57.66 Cr

|

|

M Cap (Current)

|

Rs 98 Cr (+284.31%)

|

Rs 49 Cr (-15%)

|

Chart showing increase in share price post listing for Ameya Precision Engineers Limited

Chart showing the difference in offer price and market price post listing for Ishan International Limited

Hence one can understand from the above case study that how fair valuation during IPO is important from a long term growth perspective.

How IPO Valuation is done?

Valuation of IPO typically involves the company peer analysis and use of valuation multiples like Price to Earnings (P/E), Price to sales (P/S) and Enterprise Value (EV/EBITDA) multiples. P/E is the most common metric used for IPO valuations.

However, it should be noted that the valuation for companies vary as per the sector trends, economic environment, market conditions, financials and future growth of the company.

IPO Valuation Calculator

A company can calculate its company valuation and IPO size by using our IPO Calculators feature and understand the SME IPO Valuation.

Summary- Quantitative analysis and market insight are the key for valuing a company for an IPO. Financial Performance like Revenue, profit margins, earnings growth, and cash flow are critical metrics. Market position, peer analysis and competitive advantage also drive the valuations. Last but not the least, broader economic conditions, market trends, and investor sentiment also impact the valuations.

Understand the IPO valuation Methods

0 Comments